Introduction to FSA and Eligible Expenses

Flexibility is key when it comes to managing healthcare costs. This is where a Flexible Spending Account (FSA) can play a vital role. An FSA is a special account you put money into to pay for certain out-of-pocket health care costs. You don’t pay taxes on this money, which means you’ll save an amount equal to the taxes you would have paid on the money you set aside.

To leverage an FSA, it’s crucial to know what expenses qualify. Eligible expenses typically include medical, dental, and vision care costs that aren’t covered by your insurance plan. Items like prescription medications, copays, and various medical devices are usually FSA eligible. However, not all products and services are covered. That’s why understanding FSA eligibility is important before you spend.

When considering the purchase of any health device, such as a water flosser, you might wonder about its FSA eligibility. Keywords like ‘water flosser fsa eligible’ are often searched by individuals looking to make informed decisions on utilizing their FSA funds efficiently. In the upcoming sections, we’ll delve deeper into the specifics of what makes a water flosser FSA eligible and how to ensure your oral health purchases align with FSA guidelines.

What is a Water Flosser?

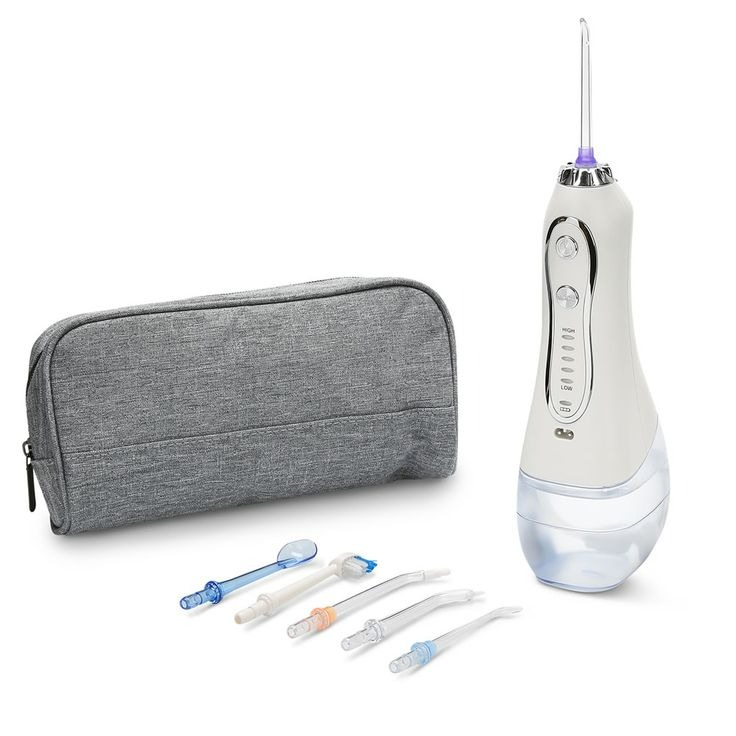

A water flosser is a dental hygiene device designed for cleaning between teeth and around gums. It uses a stream of pulsating water to remove food particles, plaque, and bacteria. This action mimics traditional flossing but with added convenience and efficiency. Water flossers come with different settings and attachments to customize the cleaning experience. They are particularly useful for people with braces, dental implants, or those who find string floss challenging to maneuver. By effectively cleaning hard-to-reach areas, a water flosser can significantly improve oral health. As oral care is vital, it’s no surprise that many seek to know if water flossers are ‘water flosser FSA eligible’ items.

The Importance of Oral Hygiene in FSA Coverage

Oral hygiene is not just about a fresh breath and a bright smile. It’s a critical part of overall health. Poor oral health can lead to various conditions like gum disease, which, in turn, can increase the risk of heart disease and diabetes. Your Flexible Spending Account recognizes this link between oral care and overall well-being. That’s why expenses toward maintaining oral health often qualify for FSA reimbursement.

Maintaining good oral hygiene is more than brushing teeth twice daily. It may require specialized devices like water flossers. These devices go beyond traditional methods to keep your mouth clean. FSA coverage typically includes products that promote health or prevent a condition from getting worse. Thus, a water flosser can be an eligible expense, as it aids in preventing gum diseases like gingivitis.

By ensuring you purchase ‘water flosser FSA eligible’ devices, you safeguard your oral health. At the same time, you make smart financial choices, using pre-tax dollars saved in your FSA. This approach aligns with the purpose of an FSA: to manage out-of-pocket health costs effectively. Remember, a healthy mouth is an investment, not just for your smile, but for your overall health too.

Criteria for FSA Eligibility of Medical Devices

To ensure a medical device like a water flosser is ‘water flosser FSA eligible’, it must meet certain criteria set by the IRS. Here are key points you should consider:

- Medical Purpose: The item must have a primary function that is medical in nature. It should be used for diagnostics, treatment, or prevention of disease.

- Qualifying Conditions: The device should aim to alleviate or prevent a medical condition. For a water flosser, this condition is often related to oral health issues like gingivitis.

- Prescription Requirement: Some items may require a doctor’s prescription to qualify. Check if your water flosser needs one to be FSA eligible.

- Documentation: Keep handy any paperwork that demonstrates the medical necessity of the device, such as a Letter of Medical Necessity (LMN).

- No Dual-Purpose: Ensure the product does not serve a dual purpose where only one is medical. Items mainly for general well-being are not FSA eligible.

Understanding these criteria can help you identify if your water flosser or other medical devices qualify for FSA coverage. Remember to keep abreast of any changes to FSA rules or eligible expenses as they can influence your purchase decisions.

How to Determine if Your Water Flosser is FSA Eligible

Determining if your water flosser is FSA eligible involves a few steps. First, verify that it has a medical purpose. Check if it serves mainly to improve dental health and prevent diseases. Water flossers meant for oral care often meet this criterion.

Next, consider the need for a prescription. While some devices require one, water flossers may not. However, this can vary, so it’s best to confirm.

Also, review the paperwork. Ensure you have documents like a Letter of Medical Necessity if needed. Such letters state the medical reasons for using a water flosser.

Lastly, remember that products for general well-being are not eligible. The item must serve a clear medical function to qualify. Always check with your FSA administrator if you’re uncertain. They can guide you on the eligibility of your water flosser.

By following these steps, you can confidently know whether you can use your FSA for a water flosser. This way, you make informed decisions and use your FSA funds wisely.

Steps to Purchase a Water Flosser with Your FSA

Purchasing a water flosser using FSA funds can be straightforward if you follow these steps. First, confirm that water flossers are indeed ‘water flosser FSA eligible’ with your FSA administrator. Plans may vary, so getting this assurance upfront avoids any future inconvenience. Once eligibility is clear, here’s what you need to do:

- Select an FSA-Approved Water Flosser: Search for water flossers marked as FSA eligible. Many retailers label them clearly.

- Keep Your Receipts: Always save receipts and any related paperwork. This comes in handy if your FSA administrator requires proof of purchase.

- Use Your FSA Card: If available, pay with your FSA card directly. It’s like using a debit card and simplifies the transaction.

- Submit a Claim: If you can’t use an FSA card, submit a claim with the receipt and required documentation to your FSA provider.

- Wait for Reimbursement: After claim submission, your FSA provider will process it. Reimbursement typically follows.

- Track Your Expenses: Keep a record of all FSA purchases for personal bookkeeping and potential future reference.

Remember to make your purchase within the FSA contribution year. Some plans offer a grace period, but deadlines apply. By incorporating these steps into your purchasing process, you ensure you’re effectively using your FSA funds to promote better oral health.

Common Questions About FSA and Water Flossers

Navigating FSA rules can be tricky, and many people have questions, especially regarding ‘water flosser FSA eligible’ products. Here are some common queries and their answers.

Q: Can all water flossers be purchased with FSA funds?

A: Not necessarily. The device must meet IRS criteria for a medical expense. Always check with your FSA administrator.

Q: Do I need a prescription for a water flosser to be FSA eligible?

A: Often, no prescription is needed for water flossers. But, policies vary, so confirming with an FSA administrator is best.

Q: What if my water flosser serves a dual purpose?

A: If the primary use is medical, like preventing gum disease, it may be eligible. Dual-purpose items generally are not.

Q: How do I prove that my water flosser purchase is for medical reasons?

A: Keep a Letter of Medical Necessity and receipts. These documents support the medical use claim.

Q: What happens if I buy a non-eligible water flosser with my FSA?

A: Funds spent on non-eligible items may not be reimbursed. You risk losing that portion of your FSA money.

Q: Is there a deadline to purchase an FSA eligible water flosser within the year?

A: Yes, purchases must be made within the FSA year. Some plans have a grace period, but you must comply with deadlines.

By asking the right questions and understanding the FSA eligibility criteria, you can make informed decisions about purchasing a water flosser with your FSA. This ensures you get the oral health benefits you need while efficiently using your FSA funds.

Maximizing Your FSA Benefits for Oral Health Care

When it comes to oral health, making the most of your Flexible Spending Account (FSA) is wise. Here are steps to maximize your FSA benefits for purchases like a ‘water flosser FSA eligible’ product:

- Review Your Plan: Begin by understanding your FSA’s specific rules. Plans may differ on eligible expenses.

- Check Eligibility Annually: Eligibility rules can change. Ensure your water flosser is still an eligible expense each year.

- Plan Your Spending: Estimate your oral care needs. Budget for an FSA-eligible water flosser within your annual contributions.

- Visit a Dentist: A dental checkup can identify if a water flosser is medically advisable. This could help with eligibility.

- Gather Documentation: If required, get a Letter of Medical Necessity from your dentist. It strengthens your claim.

- Buy Early: Purchase early in the contribution year. This avoids last-minute rushes and ensures eligibility.

- Avoid Dual Purpose Items: Choose a water flosser with clear medical benefits, not one with cosmetic features.

- Keep Records: Save all receipts and statements. This makes reimbursement smoother.

- Use It or Lose It: Remember, some FSAs have a ‘use it or lose it’ policy. Spend your FSA funds before the year ends.

- Ask Questions: When in doubt, contact your FSA administrator. They can clarify what’s covered and what’s not.

By following these guidelines, you can effectively use your FSA funds for essential oral health care, ensuring both your dental wellness and financial savings. Remember that investing in an ‘water flosser FSA eligible’ device means investing in your overall health.